the promise and peril of "easy buttons"

consider your financial options with eyes wide open.

I love quick, easily actionable steps that make life run a little bit smoother.

Based on what I see on the interwebs, I’m not alone — who doesn’t love a life hack? (Ok, I know lots of people don’t love them and are deeply tired of life-hack culture, but many of us still keep clicking anyway.) Anyway, I really love giving you tiny financial tips that you can immediately investigate and implement.

However…

The core of my financial coaching and education work isn’t based on quick tips and weird tricks. It’s based on developing a healthy, engaged-but-not-obsessive relationship with your money life. We’re working on sustainable systems that will last you for decades. Although there are a few little tips and tricks that can help, my approach is more about consistency and strategy.

Many clients come to me with a paper trail of having tried “easy buttons” before. “Easy button” is my term for a hack-like “solution” to a problem, but that is sometimes just a repackaging of the problem. Debt consolidation loans, credit card balance transfers, and a few other types of debt that kick the can down the road instead of actually making progress toward debt are all easy buttons. (To be clear: sometimes kicking the can is actually the right thing to do, but we’ll get to that.)

If you’ve used these avenues before, I promise I’m not judging you. I’m definitely judging the system that’s creating and marketing these things, and the conditions that make these “solutions” feel necessary. I know that sometimes debt (even really risky debt) is the only way you can see out of a difficult situation. But I’d like to share what I tend to see with “easy button” usage, and how to use these buttons wisely… right after the break.

The break

Club Fortuna (a.k.a. my paid community): Office Hours are 5/23/25 at 11:30am ET.

And if you’ll permit me two small flexes…

My business bestie Kendall of IQ Bookkeeping (IQBK) shares what she has been up to lately in her latest newsletter, and if you hop on over there you can see me riding shotgun on several of these adventures.

We logged quite a few lovely hours of Volunteer Income Tax Assistant service with an amazing local nonprofit.

IQBK is pursuing B Corp Certification with the enthusiastic support of the Charlotte B Corp Collective (I’m on the board!).

If you’d like some inspiration from one of my favorite humans on showing up for your values in your business, please check out IQBK’s latest.

And if you’re a Charlotte-area business that cares about social impact and sustainability, please connect with the Collective! We’ve got some fun events coming up later this year… write me if you want more details.I’m delighted and more than a little surprised to report that my graduate program thinks I’m “profile-worthy.” If you want to know a little bit about why I’m getting my masters of accounting at NC State (go Pack! 🐺), you can read the lovely spotlight feature they did about me here.

And now… back to your regularly scheduled newsletter!

They’re pushing easy buttons… at us

A piece of mail I received from USAA this week reminded me of a trend I’ve been seeing lots of lately: credit card balance transfer offers.

Not only did they tell me I could transfer other credit card balances to my USAA card and enjoy a 0% APR for a certain period of time, but they actually included three pre-printed checks I could write against my credit card to pay off any other cards or debts that I wanted to. (It had been so long since I’d encountered the paper-check-to-credit-card pipeline that I had forgotten it existed. Has anyone here actually used one of these?!)

I wasn’t thrilled that these financial instruments were just sitting in my mail pile like little fraud time bombs; I had almost tossed the mailer straight into the recycling bin, where an enterprising dumpster-diving fraudster could have easily snagged them.

PSA: burn, compost, or crosscut-shred all your sensitive personal and financial info!

Zooming out, I was also less than thrilled about where our economy is sitting in relation to credit cards, and how financial services are using that to market more debt to us.

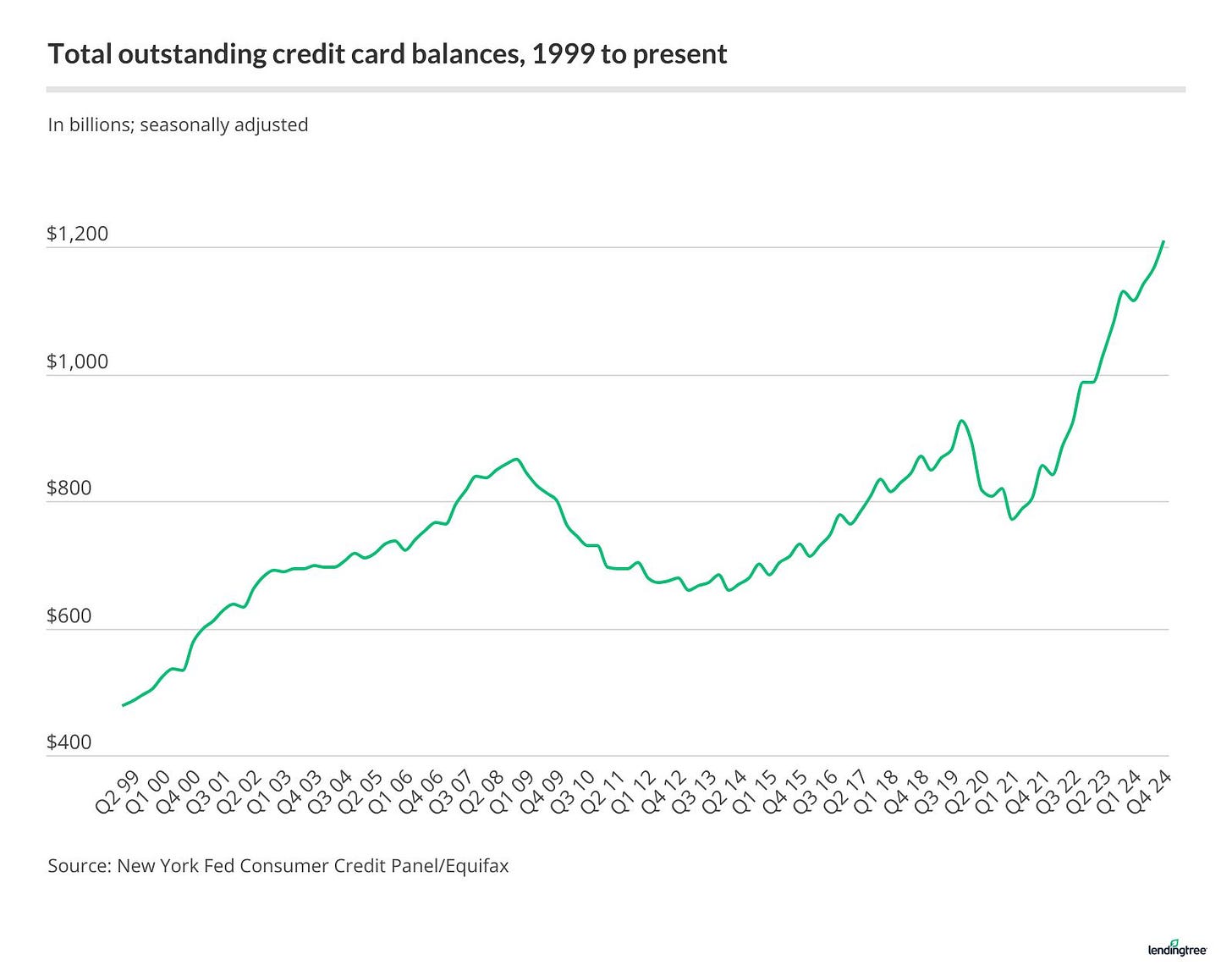

Americans’ total credit card balance is $1.211 trillion as of the fourth quarter of 2024, according to the latest consumer debt data from the Federal Reserve Bank of New York. That’s up from $1.166 trillion in Q3 2024 and is the highest balance since the New York Fed began tracking in 1999.

- Lending Tree, 2025 Credit Card Debt Statistics (emphasis added)

We can blame some of that sheer upward climb starting in 2021 on inflation, but even still: credit card debt in the US is quickly approaching a state of emergency.

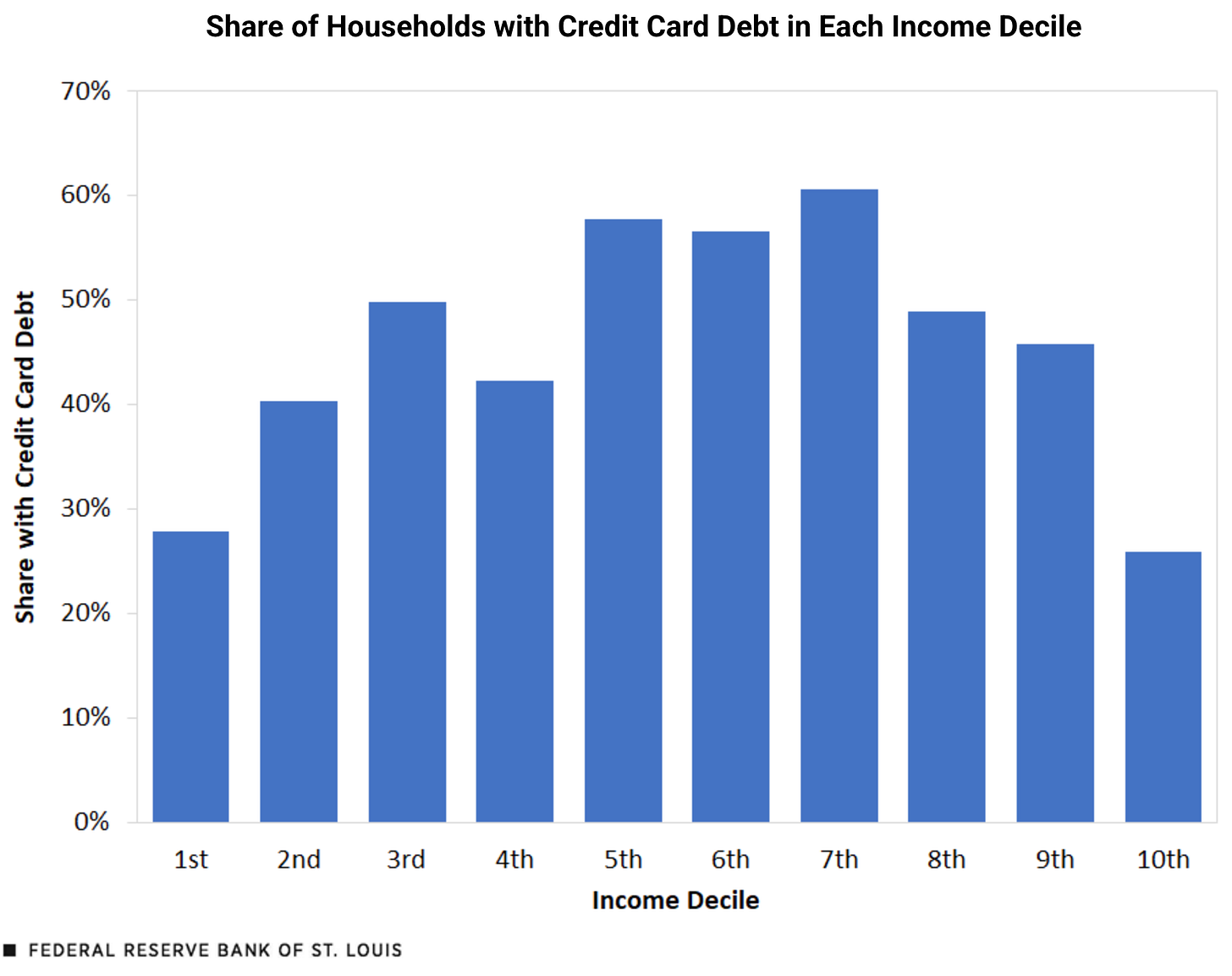

And lest you think it’s a low-income problem:

… households in the upper-middle of the income distribution—those in the fifth, sixth and seventh deciles—were the most likely to hold credit card debt.

- St. Louis Fed

I have my theories about why this is. Lower-income individuals may have a harder time getting approved for credit cards; mid-to-upper-income individuals have a much more expensive set of Joneses to keep up with.

But also… most of us don’t go into interest-bearing credit card debt on purpose. Many people feel confident they’ll be able to pay their credit card balances off within a short period of time, and then something gets in the way.

As I’ve said before, I like credit cards and use them for virtually all of my consumer spending. I enjoy both the rewards and the enhanced consumer protections, and since I pay them off every month, I don’t really think of them as debt. However, the line between “paying off your balance in full every month” and “carrying a balance” is razor-thin when you don’t have a healthy emergency fund, and 42% of Americans report that they couldn’t cover a $1k emergency with cash or savings.

So another part of my credit card theory is that I suspect mid-to-high-earning individuals are more optimistic that they will continue to earn good money. They are a bit more likely to make big bets on anticipated raises and bonuses, and may book a vacation or large purchase before the new money lands. In the current volatility of our economy, raises and bonuses feel less certain and layoffs are surging. This means those big bets may not pay off (or get paid off).

Finally, some people end up using credit cards as “survival debt” to cover expenses during an emergency or a low-income period. This often feels like the easiest, if not only, option — but with average credit card interest rates over 24%, this kind of debt can be awfully sticky to get rid of once you’re back on your feet.

Here’s the thing: Financial companies know that people are in a pinch. Thanks to all the data our financial overlords are able to access about us, they also know who, specifically, is in how much of a pinch, and they’re all too happy to offer us ways to manage our old debt with shiny new debt.

I think that USAA may have been marketing to me because I had just requested a credit card limit increase (just for funsies/score improvements, as per a previous tiny financial tip). Also, they may have noticed that my utilization rate popped a little higher than usual last month thanks to an emergency surgery for this handsome dumdum that posted right before my billing cycle closed.

Financial companies love getting people on the “just make the minimum payments” treadmill for as much as they can squeeze out of us — and the more you earn, the more they know they can put you on the hook for. They don’t actually want you to default on your debts (although they have a large budget line item to write those off because they know it will happen)… they just want you paying 24% interest forever.

But I’m guessing that’s not what you want.

What to do before you push the easy button

I have a lot of wonderful clients who come to me with credit card debt and at least one balance transfer card and/or consolidation loan. Typically, they sought those options because the staggering interest rates or huge payments on their credit cards were squeezing them painfully. They felt that if they could stop the clock on the interest and/or shrink their payments, they would create breathing room to chip away at the total balance.

Virtually all of them went back into credit card debt again, which is what often brings them to me.

From where I sit, the resurgent debt was not a product of my clients being insufficiently smart or savvy or successful or fantastic (they are all of these and more!).

Instead, it was almost always because one or more core issues in their financial lives needed to be addressed: take-home income chronically too low for their needs, lack of savings for true emergencies, or a history of tackling financial priorities in a way that cuts off options. Finally, while there is often some type of spending component, this type of chronic issue isn’t usually just impulse spending, but a narrow approach to spending-tracking that doesn’t allow for good decision-making data.

Again — I won’t judge, because I consider this a systems issue that’s preying on everyone. Pushing the easy button can be a great harm reduction strategy, too. But if you’re opening your mail and there’s an easy button calling your name, I want you to consider doing the following before you push it:

Tally up your essential spending on housing, utilities, transportation, food, health, kids, and pets. Is that total is more than 50% of your take home pay? If so, you probably aren’t earning enough and should focus at least as much on growing your household’s income as you do on trimming costs or repackaging debt.

Do you have at least $1000 in a high-yield savings account yet? If not, see what you can scratch together.

One easy button that I do enthusiastically approve of is account hacking: a large number of banks are trying to entice new customers by offering account opening bonuses (check this list out), and if you hop around just right, you can catch ‘em all. Terms and conditions always apply, but if you meet the requirements and you’re ok with the hassle of changing your direct deposit every few months… you can probably find an extra $1k in less than a year just off bonuses.

If you have way more than $1k in savings and you have credit card debt, weigh the pros and cons of paying off your cards against how much it makes sense to keep in cash. It may make more sense right now to hold on to your cash for any number of reasons (high situational uncertainty, major upcoming needs, etc.), but you want to do this with intentionality, not fear.

Are you putting a lot in a retirement account or aggressively paying off debt… but you’re running out of cash before your next paycheck? If you’ve leaned out too far over your skis and find yourself needing to float expenses on credit cards, this is more about pace. You may benefit from a mindful pause, and making sure you have enough room left in your month before you make these (otherwise smart) financial moves.

Are you a) tracking your monthly spending b) in a way that plans your spending against your monthly take-home pay while c) accounting for upcoming irregular expenses? If the answer to all of those is “heck yes,” amazing.

If you’re not… you probably know by now that Monarch Money is my favorite way to do this. You can get 50% off with code NEWYEAR2025 or use my referral link. (Disclosure: the referral link benefits me, but I only recommend Monarch because I use it to manage my own household’s money and I pay for my clients to use it, too. If you’re already a Monarch user, refer your friends using your link!)

When my clients have addressed these core issues, a balance transfer or consolidation can often make sense and accelerate their progress. For balance transfers, you’ll be paying a transfer fee that usually tacks 3-5% of the transferred amount on to your balance, so run those numbers and make sure it’s actually going to save you money by the time you’re going to pay off your debt. If there’s a chunk of debt we know we won’t be touching for a good while because it’s lower on the priority list, it can be worth it to stop the interest clock.

Thoughtfully pushing the easy button can hit “snooz” on interest, shrink payments, and free up more money to go against other debts… but only if we’ve fixed the foundations first.

Foundations vs. flips

When you build your money life with intention, it takes time. Think about a house. Not an investment property or a quick flip, but a place you want to be forever. If the foundation is cracked or sinking, patching drywall and planing off a few millimeters from sticking doors is not going to cut it. You’re diving down into your financial foundations to repair the cracks and shifts so your money life can be built to last instead of crumbling into the sea.

Easy buttons are those surface-level fixes. Some of them are marketed really well, but I want you to build a financial home that stands the test of time. Tackling these core issues is more work than applying for a balance transfer or consolidation loan, but you’ll be better prepared to create a calm and prosperous money future if you do. And that’s what I want for you.

A (slightly belated) note for Mother’s Day

I love late-bloomer stories.

Anytime I hear about someone who found a calling, talent, passion, or success after 35, 45, 55, or even later… I’m delighted and inspired. Part of it became my way of fighting back against this deep-coded belief I’d internalized somewhere in my youth that I had to accomplish everything I wanted to do before I turned 35. (Because that was when I had to start having kids? Stop having kids? My carriage would turn into a pumpkin? Not really sure, to be honest.) I was terrified of the motherhood penalty before I even knew what it was… but somehow, late-bloomer stories soothed my jangled nerves. “It’s not too late,” I could almost hear Julia Child whispering.

I can’t really call my mom, Nancy, a late bloomer because that just doesn’t do justice to everything she has accomplished during the entirety of her career, but she’s still one of my favorite beacons of inspiration. Whenever I need to be reminded that it’s never too late to do awesome new things in your working life, I can look to her.

My mom has been working in nursing since I was born: sometimes nights or weekends, sometimes as a legal nurse consultant. By the time I had my own kid, my mom was taking trips to teach neonatal resuscitation in Africa, Asia, and South America. After I had my second kid, she was promoted to nurse manager for the NICU where she’s been working for 21 years. She’s spent the last 18 months overseeing the $13M construction of her hospital’s new NICU, and she’s won more than one award just this year for being an amazing nurse leader.

In addition to being a wonderful mom and grandma, my mom is a total badass, but that’s not the (only) point I want you to take away from this.

Even if you feel like you’re headed into a season of life that might be limiting or frustrating in some way, or you’re afraid that you’re “too old” for something amazing…

it’s not too late.

Love you, Mom. 💞

Thanks for reading!

Everyone who makes it to the bottom of my newsletter is my favorite. If you enjoyed this, please tap the heart or drop a comment (or write back!). It might seem small to you, but those little acts of engagement help other people discover Fortuna Money (and really keep me going). 💖

If you’d like support untangling and calming your money life in these turbulent times, hop on my calendar for a session or a no-cost discovery call.

Finally, if you know someone who might enjoy reading this, please forward it. No one should have to money alone!

How have I not met your mom yet??? Set it up!